Investors Shift Back into Gold as Trump’s Honeymoon Period Ends

By GCRU Gold News on Monday, February 13 2017, 05:36 - Permalink

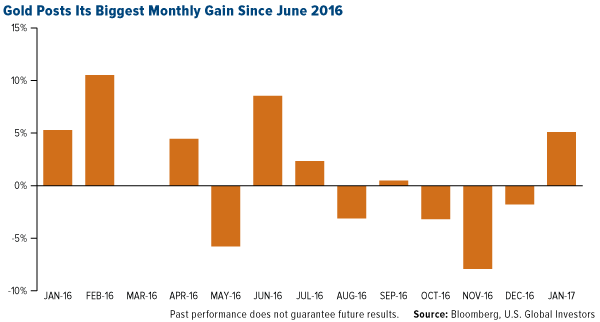

This, coupled with a more dovish Federal Reserve, expectations of higher inflation and growing demand for a safe haven, has helped push gold prices back above $1,200 an ounce. January, in fact, was the best month for the yellow metal since June, when Brexit anxiety and negative government bond yields sent it to as high as $1,370.

Demand for gold as an investment was up a whopping 70 percent year-over-year in 2016, according to the World Gold Council. Gold ETFs had their second-best year on record. But immediately following the November election, outflows from gold ETFs and other products accelerated, eventually shedding some 193 metric tons.

But now, just two weeks into Trump’s term as president, the gold bulls are banging the drum, with several large hedge fund managers taking a contrarian bet on the precious metal.