Backwardation, the Bank of England, and Falling Prices

By GCRU Gold News on Wednesday, March 28 2018, 23:31 - Permalink

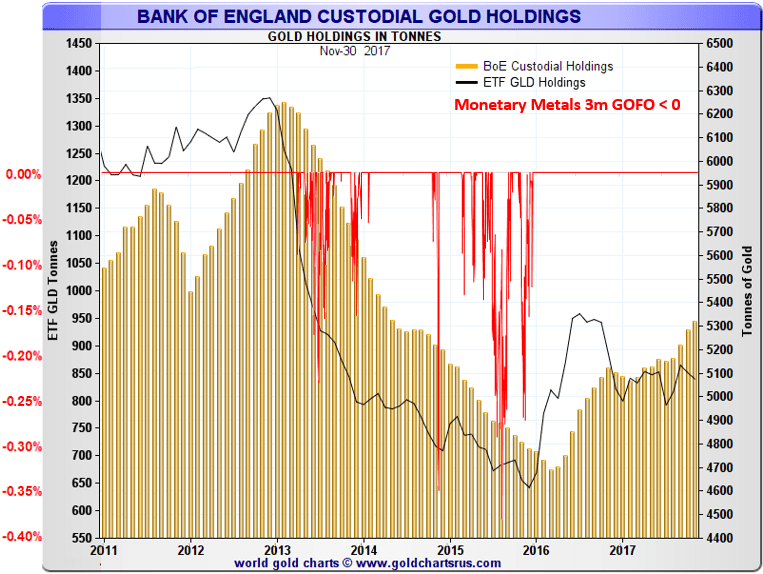

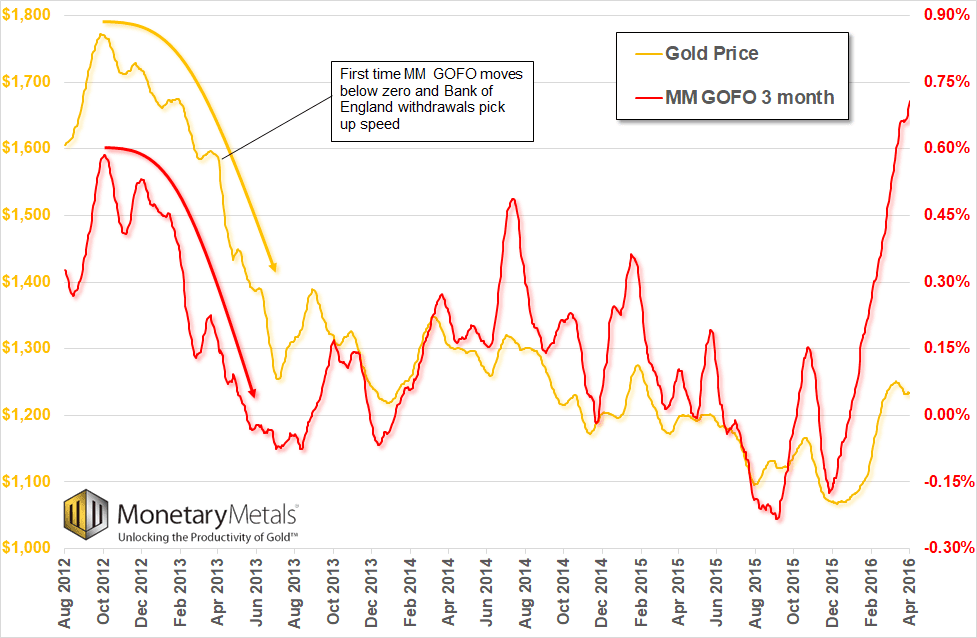

As we see in the chart above, while forward rates were positive they were in a falling trend from late 2012 onwards. Positive forward rates mean it is profitable to carry gold – buying physical gold at spot, storing (or carrying it) and selling a futures contract against it at a higher price – but this profit was declining into early 2013.

Once rates moved below zero in April 2013, the market moved into a situation where decarry became profitable. Thus bullion banks with physical gold at the Bank of England were incentivized to sell that gold in the spot market and buy it back at a lower price, via futures or forward purchases (from a mining company, for example).

This decarry pressure remained until early 2016 when the gold market bottomed and forward rates began to rise on the back of resurgent dollar interest rates, shifting the market back to the more normal contango state where the incentive was to carry gold. It is no surprise that stocks of gold held at the Bank of England recovered at this time, increasing by 600 tonnes.